The all in one Finance Platform

you’ve been looking for with Razorpay

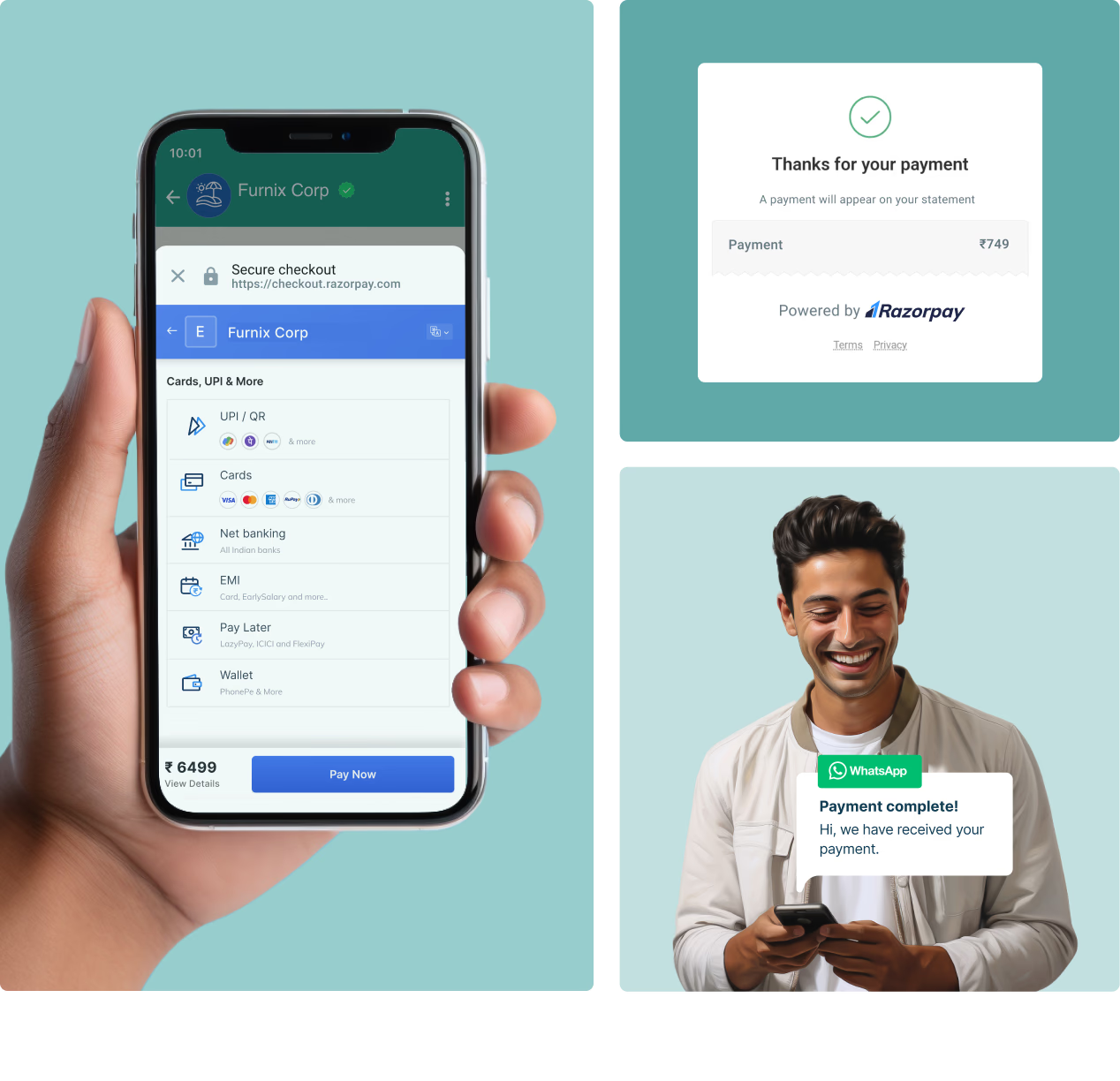

Payment Gateway

Payment Button

Payment Links

Razorpay POS

API & Bulk Payouts

Payment Pages

Accounting Integration

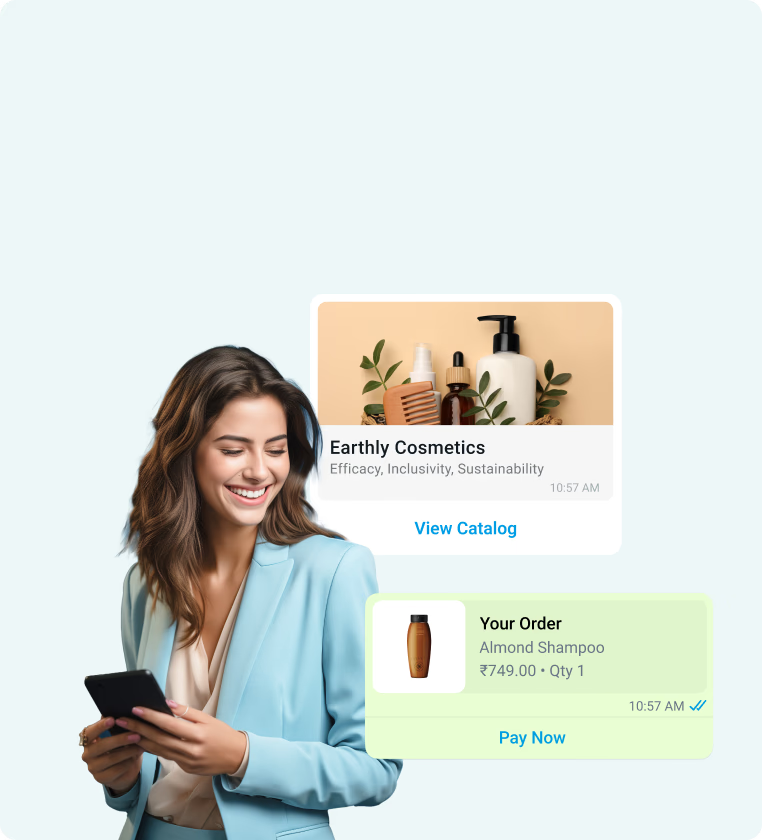

Payments on WhatsApp

Payroll for Enterprises

.

Industries

Powering every Industry

Powering all disruptors

E-commerce

Simplify payment handling with a single dashboard to enable online and offline payment collecting, increase conversion rates, and reduce fraud.

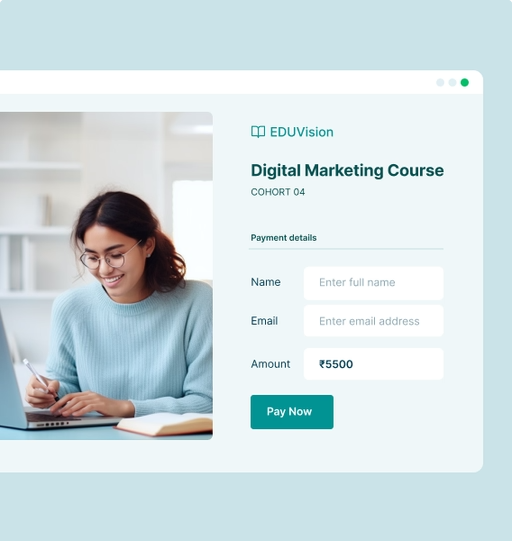

Education

Effortlessly manage fee payments and vendor payouts for tutorials, online courses, and educational institutions, even without a website.

BFSI

For a complete financial solution, automate recurring payments, streamline collection management, and hasten loan distribution.

SaaS

Easily manage payments in over 100 currencies, facilitate customized subscription payments, and effectively manage vendor payouts.

Freelance

Without the need for a website or coding knowledge, set up your branded online store and accept payments with ease.

Social Media Management

Allow the establishment of your own, branded online store and effortlessly take payments—even without a website or coding experience.

150k +

Businesses

75 +

Clients Review

43 +

Integration

Why Choose Us?

Seamless Integration: Integrate with ease for a smooth payment experience.

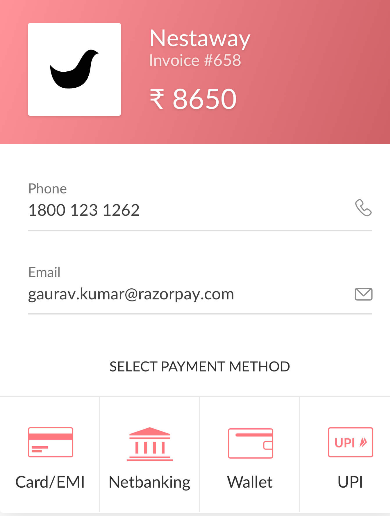

Comprehensive Solutions: Accept payments via cards, net banking, UPI, and wallets.

Advanced Security: PCI DSS compliance, SSL encryption, and fraud detection.

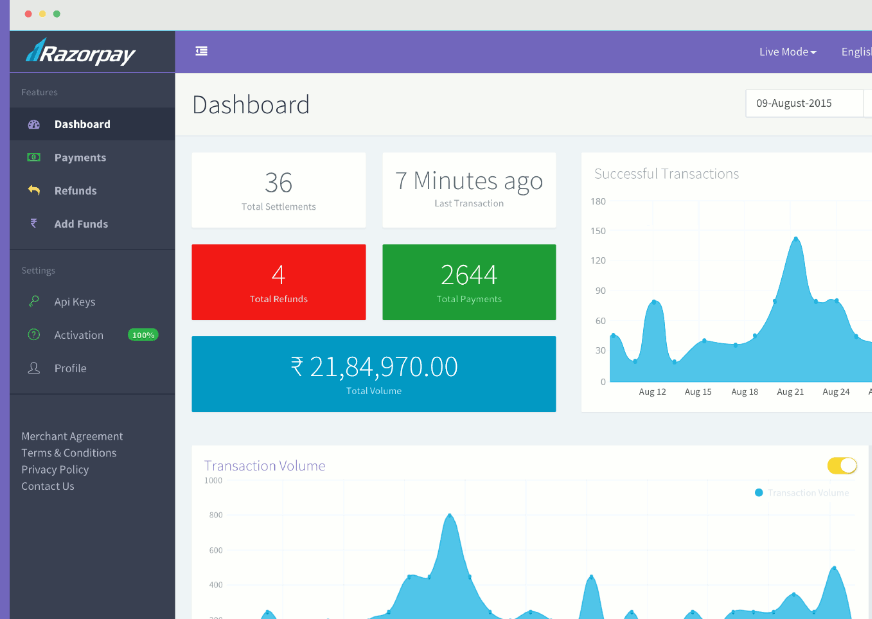

User-Friendly Dashboard: Real-time management of payments, refunds, and settlements.

Customizable Checkout: Tailor the checkout process to match your brand.

Efficient Payment Links: Easy payment collection via email, SMS, or social media.

.

Features

Empower your business with all the right tools to accept Online Payments

Checkout

We handle the rough bits

Checkout takes care of redundant things like validation while you can spend time building great products.

No Redirects

Start and end payments on the same page without moving elsewhere. No annoying redirects on your website.

Even for 3d-secure

All necessary redirection is handled within a popup. Customer never leaves your website.

Dashboard

See Key Statistics

View important metrics like previous transactions, your earnings and generate customized reports.

Issue Refunds

Refund transactions from the dashboard at the click of a button.

Complete Online Onboarding

Submit all documents on dashboard. No physical paperwork needed.

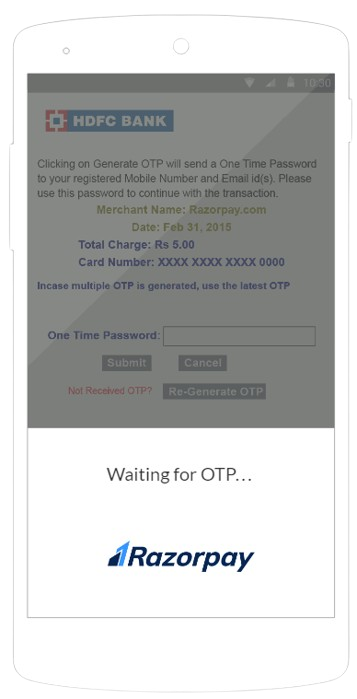

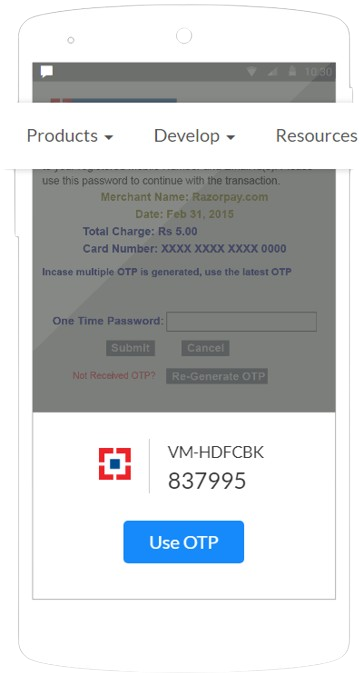

Mobile SDK

Autofill OTP with Android SDK

No need for customer to switch to messaging app just to read an OTP and then fill it manually.

Featherweight

~100KB size makes it one of the lightest payment SDKs.

Automatic Updation

Get new payment modes and features without upgrading manually time and time again.

Payment Modes

UPI

Get access to all major debit/credit card networks. Using, deliver smooth payment experience to your users.

Cards

UPI is a new mobile first payment mode for making payments to friends or businesses. Enable UPI for your online business without writing any additional code now.

EMI

Your customers can pay in monthly installments on major bank credit cards, while you receive the full amount now.

Netbanking

Accept payments through 50+ banks using netbanking.

Wallets

Razorpay provides popular wallets giving your customers freedom to pay with their favorite wallet.

API

Built for Developers

Our API is designed to be developer-friendly, offering a robust and clean interface. It lets you focus on building great products without integration headaches. With thorough documentation and dependable support, our API ensures a smooth development experience. Unlock your project’s potential with our powerful API, designed to streamline workflows and boost productivity.

Secure

Robust Security

Our PCI DSS compliant security framework ensures top-tier data protection. With us, no HTTPS or PCI DSS certification is needed for your site; all card info is securely handled through our certified system. Focus on your business while we manage security, ensuring peace of mind. Trust our solution to safeguard your data with industry-leading standards.

.

Integrations

Use Razorpay Payment Gateway with our other Products

Invoices

Send your customers GST compliant invoices with item level details to accept online payments through debit/credit cards, netbanking, wallets, UPI etc.

Payment Pages

Create custom-branded, hosted Payment Pages in a few clicks to accept payments online. Your business can go online with zero integration and tech efforts.

Smart Collect

Now accept NEFT, RTGS and IMPS transfers through customer identifiers that can be generated on-demand with automated reconciliation for payments at scale.

What Our Clients Say?

Kasturi D, Founder and CEO of Oleum Cottage on Magic Checkout

Dive into this insightful Magic Checkout case study and discover how Oleum Cottage optimized their checkout process with Razorpay Magic Checkout. Explore now!

Supriya Malik, Founder of Indulgeo Essentials on Razorpay Magic Checkout

Discover how Indulgeo Essentials optimized their checkout process with Razorpay Magic Checkout in this insightful Magic Checkout case study. Dive in now!

Bedprakash Das, Co-Founder of Sujatra on Magic

Explore Sujatra’s journey with Razorpay Magic in this enlightening Magic case study. Uncover how they optimized e-commerce experiences.

Let’s Checkout Our Latest Blogs

-

Streamlining Client Onboarding and KYC Verification with Razorpay

Introduction In today’s fast-paced digital economy, efficient and secure payment processing is crucial for businesses of all sizes. Razorpay, a leading payment gateway in India,…